Latest status in the competition between MediaTek and Qualcomm revealed, here's the industry leader!

The race continues at full speed between MediaTek and Qualcomm, seen as one of the most important competitions in the tech world.

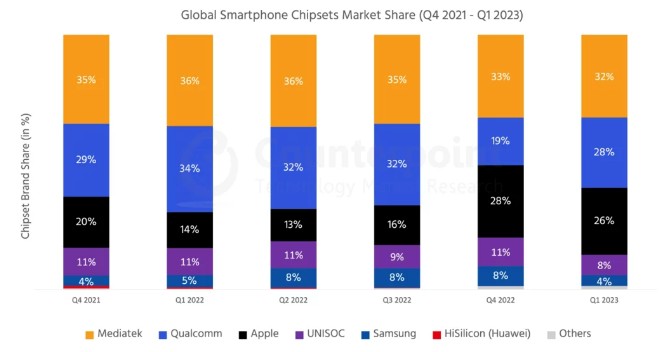

Counterpoint Research has recently published an intriguing report that provides a comprehensive view of the smartphone application processor (AP) market for the period from the fourth quarter of 2021 to the first quarter of 2023. The report sheds light on emerging trends and changing market dynamics, highlighting the performances of major industry players including MediaTek, Qualcomm, Apple, UNISOC, Samsung, and Huawei Hisilicon, and offering an outlook on future prospects.

In the first quarter of 2023, MediaTek took the lead in the smartphone processor market, claiming a 31% market share, albeit experiencing a dip compared to the prior quarter. This slump was primarily due to inventory recalibrations and a weak market demand, leading to an expected drop of more than 5% in LTE SoC shipments and less than 5% growth in 5G SoC shipments for Q2 2023. Yet, experts predict MediaTek will bounce back in the latter part of the year once inventory levels find equilibrium.

Qualcomm, another significant contributor in the AP market, clinched a 28% market share in Q1 2023. Its shipments are likely to remain constant in Q2 2023 due to inventory cutbacks, which are expected to even out in subsequent quarters.

Apple, acclaimed for its distinctive chipsets, secured a 26% market share. However, its chipsets' shipments are forecasted to diminish in Q2 2023 owing to seasonal fluctuations. Nevertheless, Apple's iOS demonstrated resilience in the face of lukewarm demand, outstripping the Android market.

Latest status in the competition between MediaTek and Qualcomm revealed, here's the industry leader!

Samsung saw a modest surge in shipments in Q1 2023, following the introduction of its Exynos 1330 and 1380 chipsets. These products targeted both premium and budget market segments, which helped in driving sales.

UNISOC, a company focused on the budget segment, registered a small uptick in shipments in Q2 2023, propelled by the increasing demand for its LTE range in devices priced under $99.

Huawei Hisilicon, currently holding less than 1% market share, could potentially stage a comeback with the launch of a new mobile phone chip in the pipeline. Counterpoint analysts project shipment volumes of around 2-4 million units for Huawei HiSilicon in 2023, primarily aimed at the mid-range segment.

Analysts at Counterpoint further emphasize the beneficial impacts of OPPO's decision to abort its chip development plans on both MediaTek and Qualcomm as this essentially means one less rival in the market. The prospective resurgence of MediaTek, the entry of potential new contenders, and the prospects of collaboration underline the dynamic nature of the smartphone AP market, paving the way for promising advancements in the near future.

Shakira still surprises at 46-years-old with her poses! Hotter than a 18-year-old girl!News & Culture

Shakira still surprises at 46-years-old with her poses! Hotter than a 18-year-old girl!News & Culture